Tax Time FAQs - What to Expect for Trust Deed Investments

Tax season is upon us and we know that making sure you gather all the necessary documentation for proper and timely filing can be a stressful and sometimes confusing process. To help mitigate some of the confusion, we want to make sure you are prepared for what type of tax documents you should expect to receive directly from Ignite Funding, if any.

The tax documents you receive is determined by the account type that you invest with and if any of your investments have experienced a foreclosure. Below are some of the frequently asked questions we receive each tax season. If you can’t find an answer to one of your own questions below, please reach out to your Investment Representative for additional clarification.

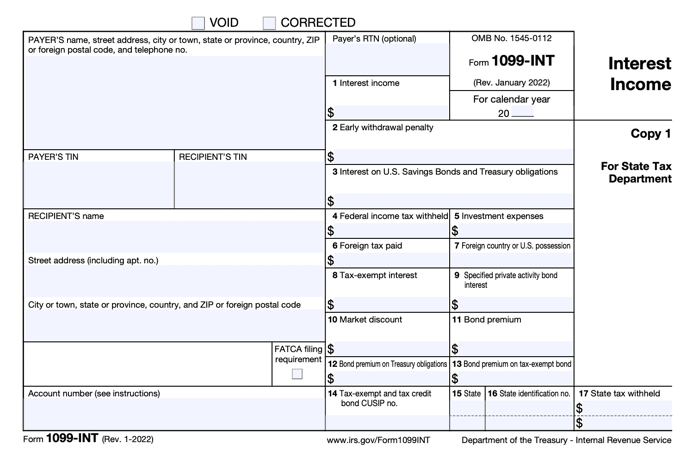

What is a 1099-INT form?

It is the IRS tax form used to report interest income when you file your taxes.

When will 1099-INT forms be released by Ignite Funding?

1099-INT form release deadline is typically January 3.

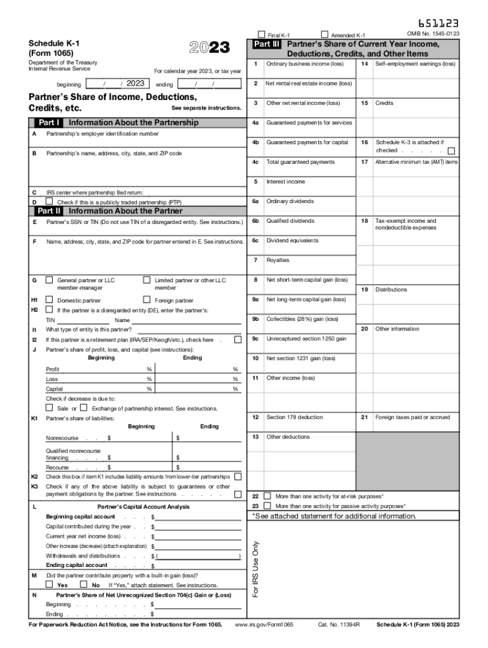

What is a K-1 form?

It is an IRS tax form (Form 1065) issued for an investment in partnership interests. The purpose of this form is to report each partner’s share of the partnership’s earnings, losses, deductions and credits as they apply.

When will K-1 forms be released by Ignite Funding?

K-1 form release deadline is typically March 31. However, due to the process of collecting the information required for a K-1 form, Ignite Funding does have the ability to utilize an extension for more processing time with the IRS. Forms will be available on the client portal or mailed to you if designated on your account.

What happens if Ignite Funding utilizes their extension for K-1 forms?

If Ignite Funding utilizes their extension to request more time to produce K-1 forms, then you will need to request an extension with the IRS for filing your taxes.

Requesting an extension to file your taxes is your right as a tax-paying citizen and incurs no penalty to you as long as you follow the proper extension procedure. Please work with a tax professional or refer to the IRS website for guidance on requesting an extension. Ignite Funding will notify you should an extension be utilized.

How will I know if I am looking at a 1099-INT form or a K-1 form?

1099-INT form Sample

K-1 form Sample

Where will I retrieve my tax documents?

ALL tax documents will be made available online on the Ignite Funding website in the client portal.

I have never logged in to my Ignite Funding user portal. What should I do?

If you have never logged into your portal, please contact Loan Processing at loanprocessing@ignitefunding.com to retrieve your username. Once you have your username, you will be able to reset your password. The Password Reset email will go to the email that is connected to your Ignite Funding account. If your email has changed, contact loan processing to update your records.

If I invest with a qualified retirement plan account, or Self-Directed IRA, will I receive a tax document from Ignite Funding.

NO, you will NOT receive any tax documentation directly from Ignite Funding for an IRA account. Any and all tax documentation is handled by the custodian or administrator that your retirement account is held with in order to maintain its tax deferred or tax-free status. Please contact that company or custodian for tax information regarding your retirement account.

How do I know if I invest with a qualified retirement plan account, or Self-Directed IRA, with Ignite Funding?

If you do not invest with funds directly from your personal or business bank account, nor receive any payments directly to you or your personal or business bank account, you are most likely investing with a qualified retirement plan account.

I invest with a Cash Account, and HAVE NOT experienced a foreclosure in any of my investments, what tax documents will I receive?

If you invest with a Cash Account (i.e. individual or joint, trust, business) you will receive a 1099-INT form.

I invest with a Cash Account, and I have experienced a default with one or more of my investments, what tax documents will I receive?

If one or more of your investments is in default but the property WAS NOT taken back through foreclosure, you will still receive a 1099-INT form for the remaining investment you received interest, and any interest received in the previous year on the investment in default.

If I invest with a Cash Account, and I HAVE experienced a foreclosure in my investments, what tax documents will I receive?

If one or more of your investments experienced a default AND the properties were taken back through foreclosure prior years, you will receive a K-1 form.

If I invest with more than one type of Cash Account, will I receive more than one tax document?

If you invest with multiple Cash Accounts (i.e. trust & business, or individual & business, etc.), you will receive a 1099-INT form for each account.

I have a combination of investments that are in good-standing and have experienced Foreclosures, what tax documents will I receive?

You will receive both a 1099-INT form for the investments that are in good standing and a K-1 form for the investments taken back through foreclosure.

If I invest with both a Cash Account and a qualified retirement plan, or Self-Directed IRA, will I receive more than one tax document?

NO, you will only receive a 1099-INT form for your investments in your Cash Account. Any and all tax documentation for investments made with your qualified retirement plan is handled by the custodian or administrator that your retirement account is held with in order to maintain its tax deferred or tax-free status.