Why Borrowers and Investors Choose Ignite Funding

Most bankable borrowers will have multiple sources of financing/capital at their disposal, including friends & family, banks, and alternative lending options like Ignite Funding. But if banks are known to have the most affordable capital out there, why would borrowers need so many financing options? Below are a few of the main reasons why borrowers come to Ignite Funding to fund their projects:

■ The Borrower or Project Doesn’t “Fit Inside the Box”

Banks and friends & family set very specific parameters to be a viable candidate for financing. These parameters often create roadblocks for borrowers in many ways, but here are a few of the most common: 1) the borrower out-grows their regional bank and/or maxes out their friends & family available capital, but is too small to qualify for national bank financing; 2) The borrower encounters unique project opportunities but the assets do not meet bank or friend & family standards; or 3) the borrower is looking to evolve with the changing market, but the product or projects do not meet bank or friend & family standards. At Ignite Funding, we think like a borrower, which is why we are an asset-based lender. This enables us to think outside the box and bridge this gap in financing left by banks and friends & family financing.

■ Predictable Closing Times

Banks are notoriously slow in their due diligence to decide whether they will fund a project, making them unpredictable and inevitably unreliable. At Ignite Funding, since we are an asset-based lender, our due diligence period is shorter. Therefore, we can inform the borrower if we will pass or we will fund the project in a matter of weeks. This can be detrimental to a developer who is in the process of acquiring a piece of property with a hard close date, giving them the ability to search more quickly for other sources of financing if needed.

■ Bridge Financing

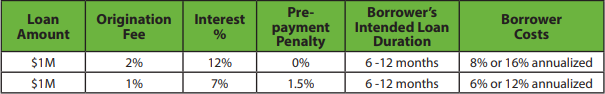

In order to lock-in long-term cashflows and ensure their ability to recoup the costs of underwriting the loan, the banks implement prepayment penalties. For many real estate projects, the borrower is typically acquiring and/or adding value to the property with the intent to sell or refinance in a shorter amount of time than is needed with a long-term bank loan. Ignite Funding does not implement a prepayment penalty, allowing borrowers to be more versatile and move-on to new projects more quickly. This can translate into greater returns for the borrower by completing more short-term projects and contribute to their overall success in the long run.

The below chart illustrates an example of the borrower’s costs associated with bank vs. alternative financing on a short-term project. As you can see, the costs are comparable.

In turn, investors benefit from Ignite Funding’s ability to lend to bankable borrowers on short-term Trust Deed investments that are collateralized by a thoroughly underwritten property, and yield double-digit annualized returns paid through to investors as monthly fixed-income.

Care to learn more? Listen to our podcast that dives deeper into this topic: