Investor – Do You Know When the Interest Income Clock Starts?

As a Trust Deed investor at Ignite Funding, you know that you are earning a monthly income at a fixed annualized rate of 10% - 12%. However, your first month of interest will vary depending on when the interest clock starts.

When it starts depends on the status of the loan. The status will either be (1) you are part of an original loan funding where the loan has not yet closed, or (2) the loan has already been funded and closed, and you are being placed on “assignment”.

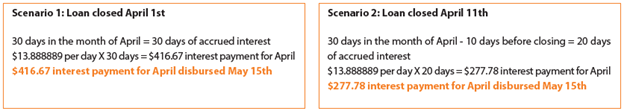

1. Original Loan Funding

The clock for original loan funding interest starts on the day the loan closes. The original loan closing date may affect the number of days of interest accrued for the month.

Example - $50,000 principal investment on a loan with a 10% interest rate

$50,000 loan funding X 10% interest rate. = $5,000 annualized return

$5,000 annualized return / 360 days in year = $13.888889 per day

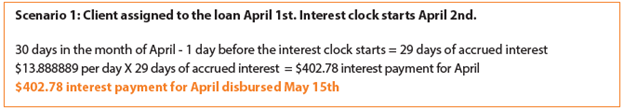

2. Placed on Assignment

Clients are officially “assigned” onto a loan when all investment documents and funds have been checked in. The interest clock then starts the next business day.

Please Note: Ignite Funding monthly statements reflect the date you were assigned to the loan, NOT the date you start earning interest.

Example - $50,000 principal investment on a loan with a 10% interest rate

$50,000 loan funding X 10% interest rate. = $5,000 annualized return

$5,000 annualized return/ 360 days in year = $13.888889 per day

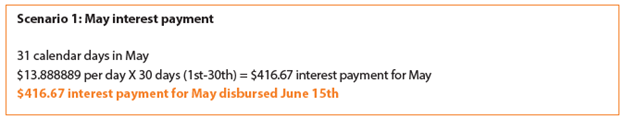

After the First Month

After the first month, your following monthly interest payments will be calculated based on 30 days of accrued interest, regardless of the number of calendar days in the month.

Example - $50,000 principal investment on a loan with 10% interest rate

$50,000 loan funding X 10% interest rate. = $5,000 annualized return

$5,000 annualized return / 360 days in year = $13.888889 per day

Calculate Your Annualized Interest

Depending on the loans you are invested on, you are earning anywhere between 10% to 12% in interest annually on your investments. For example, if you invest $10,000 on a loan earning 10% annually and the loan runs through a full cycle of 12 months; you will have earned $1,000 in a years’ worth of accumulated interest ($10,000 x 10% = $1,000).

FAQ

When is interest paid each month?

Monthly interest payments are disbursed on the 15th of each month and is paid in arrears. This means that each payment accounts for the previous months’ worth of accrued interest. For example, when you receive an interest payment on April 15th, that payment was for daily interest accrued during the month of March.

How long will I earn interest on my investments?

This will depend on the term length of the loan you are invested on. It is important to note that Trust Deed investments are short-term by nature, which means that loans can be paid off before a year has passed. That is why it is important to reinvest your funds quickly to help mitigate interest downtime and continue to realize a 10% to 12% annualized rate of return.

Learn how to maximize the benefits of Trust Deed investments with these 3 secret ingredients.

What should I do if I change to a different bank account?

To ensure that your interest payments and pay-offs ACH to the correct bank account, you must update your banking information with Ignite Funding. On the Ignite Funding website, navigate to the Investor Forms page and select the "Disbursement of Monthly Interest Payments & Pay-offs Form". Complete the form with your new banking information, provide a handwritten signature, and then scan and email a copy of the form with a copy of a voided check to loanprocessing@ignitefunding.com or you can send a file securely online through our file drop.

What should I do if I am moving to a new address, and I receive checks in the mail?

To ensure that your interest payment and pay-off checks are sent to your new address, you must update your address information with Ignite Funding. On the Ignite Funding website, navigate to the Investor Forms page and select the "Address/Email Change Form". Complete the form with your new address, provide a handwritten signature, and then scan and email a copy of the form with a copy of a voided check to loanprocessing@ignitefunding.com or you can send a file securely online through our file drop.

What should I do if I switch to a new Self-Directed IRA custodian?

If you intend to transfer your active investment assets, they will need to be retitled in the name of your new IRA account. Please contact your Investment Representative for further instruction.

If there is an issue with my interest payment, who do I contact?

If you need assistance with your interest payments, please contact your Investment Representative.